Maximize Your Tax Savings: Understanding Section 179 at Ocean Cadillac

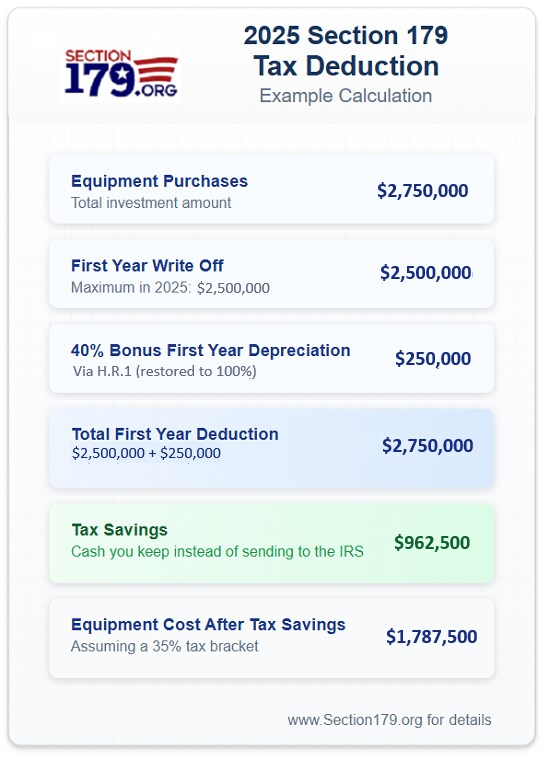

As a business owner in Miami, smart financial decisions drive your success. At Ocean Cadillac, we help you leverage powerful tools like the Section 179 tax deduction to make your next vehicle purchase both practical and financially advantageous. This guide explains how you can significantly reduce your tax burden while acquiring the luxury vehicle your business deserves. With updated limits for 2025, Section 179 offers even greater opportunities for strategic tax planning and business investment.